There is a “sting in the tail” to the government’s EPC rating targets in the UK rental market, with the majority of existing homes falling short.

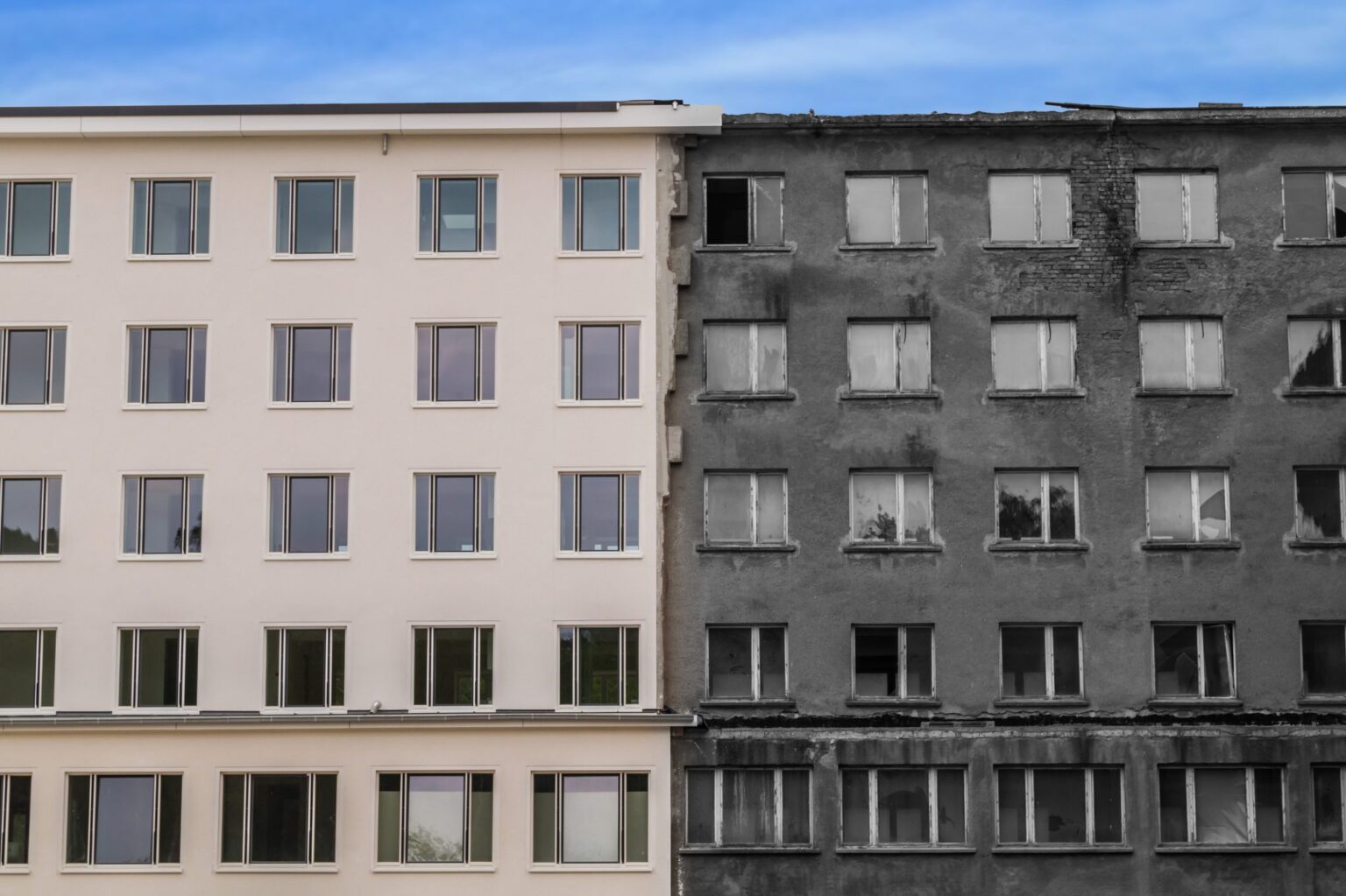

A new analysis of all energy performance certificate (EPC) ratings in England and Wales has been released by the Department for Levelling Up, Housing & Communities, and it demonstrates a distinct polarisation in the housing market.

Between October and December 2021, 84% of new-build properties were given an EPC rating of an A or a B. These are the top classifications available, meaning that they are of the highest standards in terms of energy efficiency. For prospective buyers and tenants, this is a huge selling point for not only keeping energy bills down, but for protecting the environment.

By contrast, 81% of existing properties – older homes – received a rating of C or D, while only 4% achieved an A or B rating. What’s more, 12% of existing homes scored just E in their rating, with 2% achieving F and 1% getting G.

Only 12% of new-build homes were given an EPC rating of C, and less than 6% in total scored between D and G.

Why is it important?

Property investors and landlords operating in the private rental sector need to consider the EPC rating of their property as a matter of urgency, according to many industry insiders. Since last year, all rental homes have had to achieve a rating of E or higher in order to operate.

There are some exception; landlords who have carried out work up to the government’s spending cap and still fail to meet the minimum requirement can apply for an exemption. However, as higher ratings become the industry norm, as well as a selling point for prospective tenants, this may not be a long-term solution.

What’s more, the government plans to raise the bar in 2025, but many in the market are speculating this could happen sooner. It would involve properties needing to achieve a minimum rating of C to operate legally, and judging by the most recent statistics, this would leave thousands of homes falling short of requirements.

Scott Clay, at specialist lender Together, says: “While the government’s EPC band C targets demonstrate the commitment to reaching net-zero; it is an initiative that carries a sting in the tail.

“First-time buyers hunting for a ‘character property’ need to consider this as they could find themselves having to shelve out unexpected cash to bring their older home up to the eco-standards required – and quickly.”

The same applies even more so to property investors hoping to let out their properties.

Getting a top EPC rating

An energy performance certificate (EPC) demonstrates the energy efficiency level of a home, and a certificate is required every time a property is built, sold or let. Once an EPC assessment has been carried out, the rating is valid for 10 years, and prospective buyers or tenants can access this when considering a property.

The higher the rating (A or B), the more energy efficient the home is. The certificate also shows what rating could be achieved if improvements were made.

For property investors and landlords considering their next purchase, energy efficiency is currently a massive topic. There’s more awareness surrounding carbon emissions and the environment than ever, and tenants of the future will increasingly value this as something they want from their rental home.

Investing in a new-build, or even a newly converted, renovated property, is one way an investor can ensure they are ahead of the curve. Not only do new-builds have the highest EPC ratings, making them cheaper to run, but they also have many other advantages. Below are some of the main highlights of new-build homes.

The benefits of investing in a new-build

- No chain – When buying an existing property, there is often a chain above you, which can add stress as well as slow things down if people higher up the chain pull out, whereas this isn’t the case with new-builds. Buying a new property also removes the risk of being gazumped.

- Discounts – Developers will sometimes offer money-off incentives enabling larger savings than when buying privately, particularly when a building project is in its early stages.

- Peace of mind – New-build homes come with an NHBC (or equivalent) 10-year warranty, which includes a two-year builder warranty followed by an eight-year insurance agreement against damage to your home caused by building errors that affect the main structure.

- Everything brand new – It goes without saying that when buying a new-build, all the fixtures, fittings and decor will be brand new, modern and unused, with most new appliances coming with their own warranties. Developers often install the latest smart technology as a selling point, too, with the most up-to-date energy efficiency and ventilation technologies.

- Cheaper and greener – New-builds are substantially cheaper to run than the majority of existing properties, which offsets some of the premium paid at the outset over time. They are built to the latest environmental standards, with better insulation, more efficient heating systems and, as mentioned above, better appliances. According to the Home Builders Federation, more than 80% of new-builds have an A or B energy performance rating, while only 2.2% of older homes have the same.

- Customise – If you invest before or during the building phase (off-plan), you will probably have the opportunity to choose things like the decor and even the appliances and layouts yourself.

- Great for tenants – Compared to older, tired rental properties, new-builds are much more appealing to tenants because they won’t have to worry about issues like damp, condensation or unreliable old boilers and heating systems that sometimes plague older rental properties. The fact that bills are much lower is an added bonus for tenants.

- Less hassle for landlords – Property investors often have to deal with repairs and maintenance on their rental properties, but much of this is taken away with a new-build as the chance of appliances wearing out is significantly lower.

- Compromise – If a brand new building isn’t for you, investing in a newly redeveloped existing building or conversion can be a good compromise. Everything internally is still brand new, often with optimised insulation and other mod cons to improve energy efficiency, but this option can offer more character than a new-build.

BuyAssociation has a range of property investment opportunities across the UK, specialising in off-plan, new-build and high quality homes. Browse a selection of what is available, or get in touch for more information.