As life returns to a “new normal”, the way people choose to work and live continues to evolve. A fresh report from Savills highlights some interesting trends that are emerging in the housing market.

Throughout the pandemic, cities in particular have faced some massive changes. When everyone in the country who was able to was working from home, many city centres became ghost towns. This not only affected businesses and high streets, but also housing demand. For many, remote working has enabled people to relocate to places with more space, lowering demand in some major cities.

However, a new Savills report looks at the flip-side of this. In smaller cities in particular, some workers are beginning to return.

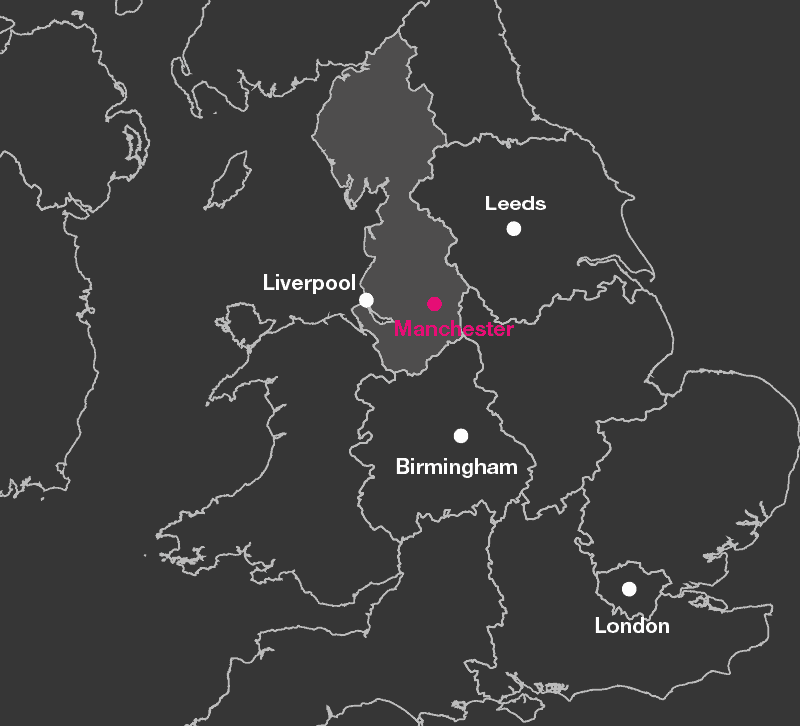

Manchester and Birmingham regaining momentum

The report highlights Manchester as one location on the up. In fact, out of the whole of Europe, Manchester is second on the list of cities that has seen travel within the city return to almost pre-pandemic levels, at 96%. Birmingham is also high on the list in fourth place, with 89% of pre-pandemic travel returning.

On the other hand, larger cities such as London are slower to see the same level of mobility. The capital is currently seeing just 66% of travel return compared to pre-COVID. Although the capital’s housing market will always attract investment, the data shows the benefit of considering other locations, too.

For many, the return to work will still include “hybrid working”, between home and office. From a housing market perspective, people want locations with “larger homes, longer commutes and faster broadband speeds”.

The report adds: “However the office isn’t going to go away either, meaning that location factors still matter in selecting residential product.

“Residents will still value additional space, but it is likely that they will also desire to be within reasonable commuting distance of city centres for the days they choose to work in the office.”

Growing rental demand for millennials out of town

As Savills points out, the oldest “millennials” are now turning 40. This means large numbers of people who are “more accustomed to renting and the flexibility it brings” are now starting families. Often, but not always, this means they are on the lookout for more space and a better work-life balance away from a city.

Therefore, Savills predicts a rise in demand for single family rental homes in the suburbs. While build-to-rent and multi-family living are still key components in the private rented sector, this is a growing area of focus.

Savills adds: “In the wake of the global financial crisis, institutional investors began buying distressed housing stock and converting it into rental properties on the private market, particularly in the US. There is also an emerging trend of purpose-built single family rental housing in both the US and UK.

“In August 2021, TPG Real Estate Partners and Gatehouse Bank launched a UK single family BTR joint venture. It will focus on new-build single family homes for private rental with the capacity to build an investment portfolio with a total value in excess of £500 million.”