From 1st July this year, new rules are coming in for private buy-to-let landlords regarding the electrical safety of their properties. Here’s how this could affect you.

In the UK, landlords are required by law to make sure that any property they rent out is a safe place for people to live. This applies to fire safety, gas safety and electrical safety, and all landlords must fulfil the minimum requirements on these areas.

As part of the government’s drive to improve standards across the private rented sector (PRS), new proposals to increase requirements for landlords around electrical safety were put before parliament last month.

These more detailed regulations are expected to come into effect from the beginning of July this year, affecting thousands of buy-to-let landlords across the country as part of the initial rollout. And by April 2021, the new standards are expected to apply to every privately rented property across the country – so it’s a good idea for landlords to prepare for this now.

How are the rules changing?

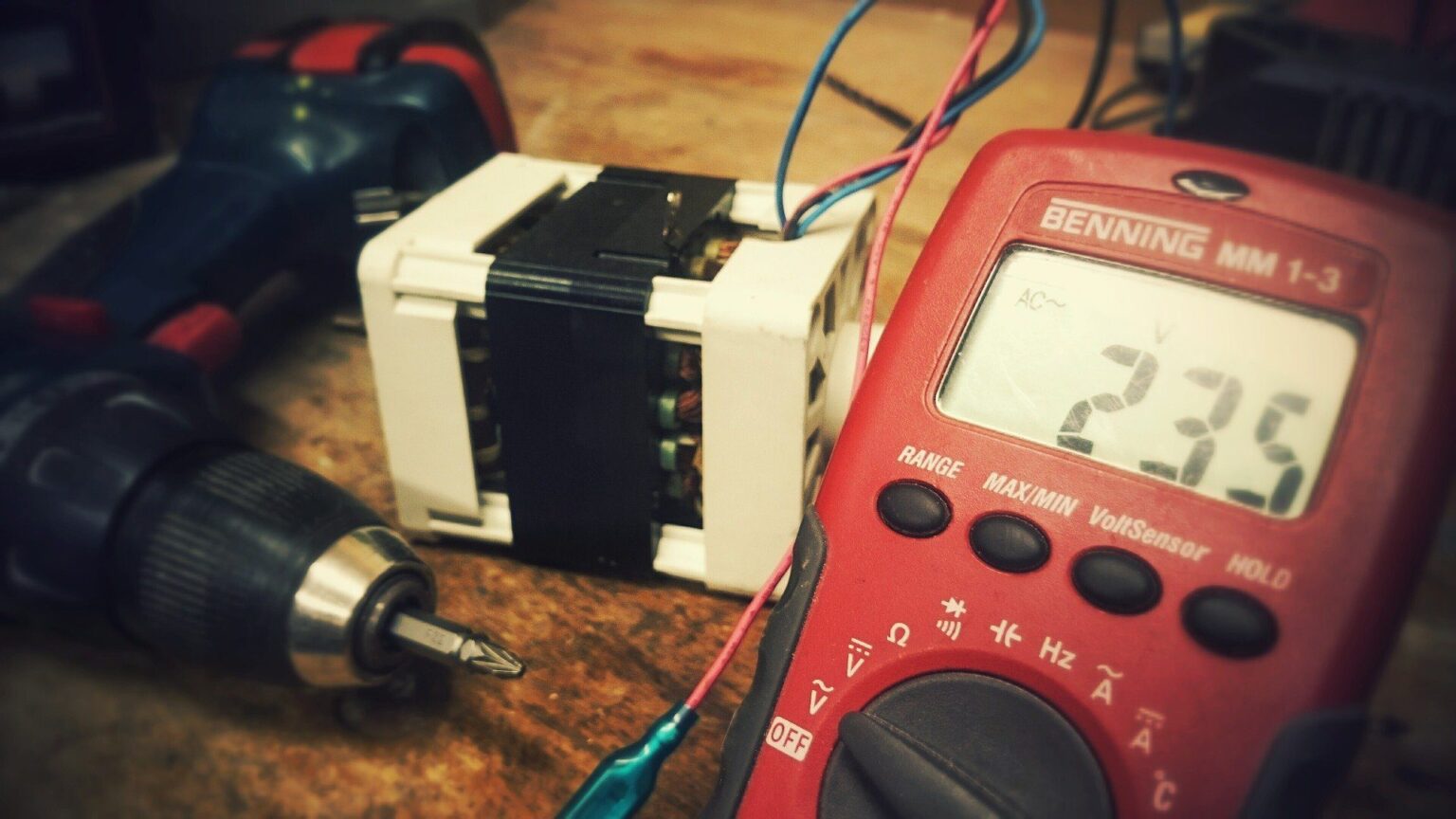

At present, anyone who owns a rental property must protect tenants from the risk of electric shock, or fires from electrical items. This involves checking and maintaining electrical installations – such as sockets or light fittings – over the course of a tenancy to ensure they are safe.

Where a property is furnished or part-furnished and this includes appliances, such as a toaster or TV, appliances must have at least the CE marking to show that it meets all the requirements of European law. For houses in multiple occupation (HMOs), inspections must be carried out every five years by a registered electrician, but this is not currently required for a non-HMO property.

Under the up-coming regulations, from July all new or renewed private tenancies in England will need to have all electrical installations inspected and tested by a qualified person before the start of the tenancy. They must then be inspected and tested a minimum of every five years after that, unless the safety report requires it to be done more often.

Tenancies that are already in place or ongoing will have the same rules applied to them from 1 April 2021, so they have slightly more leeway. After this point, the same rules will apply to all private tenancies in England, including HMOs.

What do landlords need to do?

Landlords who take on new tenants after 1st July must employ a qualified person to test all electrical fixtures and fittings prior to the new contract. They must obtain a written report of the findings, which they supply to the tenant before they occupy the property, as well as to any new tenants who request one after this point.

For existing tenants if a tenancy is being renewed after this date, landlords must supply a copy of the findings within 28 days of the inspection being carried out. They must also keep a copy for their records, and in case the local authority requests to see one.

If any faults are found, landlords must ensure any repairs are carried out as soon as possible, but at least within 28 days of the inspection – and this must be done by a qualified person, too. Once all electrical fixtures and fittings are compliant, the report can then be issued to existing or future tenants.

What if you don’t comply?

Whether you’re an experienced property investor or just an accidental or small-time landlord renting to friends, the rules apply to everyone and it’s vital that you keep ahead of updated regulations like this one. You might have employed a property management company to manage the letting for you, in which case it should be agreed who is responsible for the safety aspects of the property.

A local authority can step in with remedial action if you are found to be renting a property after 1st July on a new tenancy, or after 1 April 2021 for existing tenancies, without the above requirements being fulfilled. The council has the power to issue a fine of up to £30,000 to landlords who refuse to comply.

While the new requirements will come at a cost to the landlord, they are generally seen as a positive step towards further professionalisation of the industry. So-called “rogue” landlords are in the minority in the UK, despite the publicity they get, so any steps towards ousting bad landlords running unsafe rentals in favour of good ones is potentially beneficial for the reputation of the PRS.