1 in 7 people are currently in the research process of building their own home. Dubbed as self-builders, this form of development is on the rise with 13,000 custom and self build homes constructed in 2017.

Currently, only 8% of new UK homes are custom or self-built, but government incentives have been introduced to try and boost the number of self and custom built homes from 13,000 to 20,000 (35%) in the UK every year.

With over 40,000 people registered on the governments Right to Build scheme (which allows local authorities to look to make plots available to self-builders) since it opened last year, evidence suggests that self-building is becoming a more recognised and viable choice for many people.

Securing capital is getting easier

Securing the capital to undertake such an expensive venture is one of the biggest challenges for aspiring self-builders.

Traditionally mortgages for self-build projects have been difficult to secure, but an increasing number of lenders have started to offer mortgage products for this market. Since the risk to the lender is quite high, borrowers require a significant deposit of at least 20/25% and will have to plan for receiving the finances in stage payments, as each phase of the build is completed.

While the higher rates for self-build mortgages might initially be off-putting, they do enable you to build your ideal home without raising all the funds yourself. Plus you’re only tied in until the build is completed when you can remortgage onto a standard mortgage with a lower rate.

Stamp duty is only paid on the land

Self-builders can save thousands on stamp duty, as it only has to be paid on the land itself if the cost passes £125,000 and that increases to £300,000 for first-time buyers. (First-time buyers can apply for self-build mortgages too).

If you’re flexible on location, you can save thousands

Where you choose to self-build can make a big difference to your bank balance. Land is considerably cheaper in certain areas in the UK. For example, the average price of a plot in Liverpool at £817,000 is seven times more expensive than in Manchester which is a mere £112,090, according to research by Insulation Express for National Custom and Self-build week. Their research has also identified the top ten cheapest cities in the UK for aspiring self-builders:

1.Inverness – £91,062

2.Dundee – £95,000

3.Manchester – £112,090

4.Salford – £119,833

5.Durham – £128,684

6.Wolverhampton – £146,666

7.Southampton – £156,666

8.Plymouth – £170,000

9.Lincoln – £173,316

10.Newport – £195,500

And the ten most expensive:

1.Liverpool – £817,000

2.Oxford – £508,333

3.Leeds – £388,000

4.Portsmouth – £371,250

5.Derby – £356,428

6.Peterborough – £328,741

7.Cambridge – £323,333

8.Cardiff – £303,750

9.Birmingham – £274,714

10.Edinburgh – £256,000

According to the research, rising house prices are a driving force behind the increase in self-builds as people want more for their money than what’s available in today’s housing market; plus there’s the added bonus that self-build homeowners on average gain 29% in the value of their completed home.

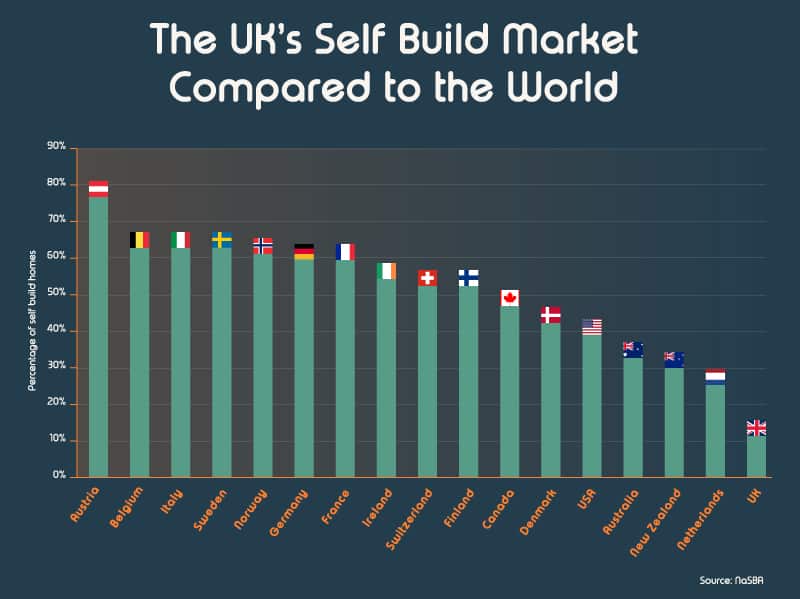

It’ll take time for the UK to catch up with the rest of the world though. In Canada 50% of new homes are self-builds, and in Austria, it’s a massive 80%!