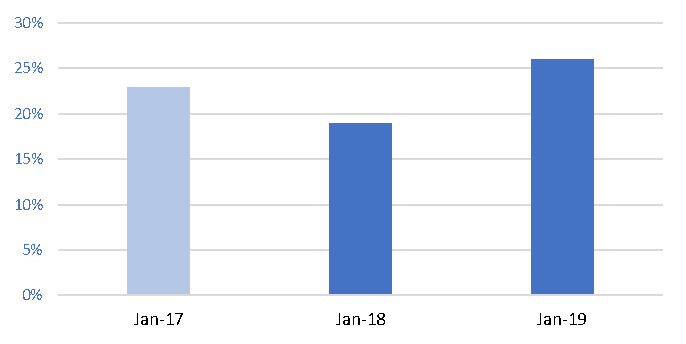

ARLA Propertymark’s latest PRS report has revealed that there has been a 7% increase in the number of tenants experiencing rents this year. With 26% of agents seeing buy to let landlords increase rents, increasing over last December.

The report went on to show that despite rental stock increasing, the demand from tenants is continueing to outstrp supply. With the number of tenants registered per brand rising to 73 up from 50 in December.

Demand from prospective tenants has also increased in January, with the number of house-hunters registered per branch rising to 73, up from 50 in December.

“This month’s results are another huge blow for tenants. With demand increasing by 46 per cent from December, and rents starting to rise in response to all of the cost increases landlords have experienced over the last few years, tenants are in for a rough ride.”

“With the Tenant Fees Act passing its final hurdle in the House of Commons and receiving Royal Assent this month, tenants will continue bearing the brunt, as agents and landlords start preparing for a post-tenant fees world.” David Cox Chief Executive

Passing on cost to tenants

The report is positive for landlords and property investors looking for good rental yields. UK Housing remains in high demand, increasing the competitions for prospective tenants and owner-occupiers. Despite the recent political instability the fundamentals of the UK housing market (apart from the high end central London markets), have remained healthy and continue to show signs of positive growth.

Despite efforts to protect tenants and dampen the property market. It’s clear that the extra cost, whether it’s the Letting Fee ban or Section 24. These costs will are beingpassed onto the tenants. Further increasing rents in the future.

Modern landlords misrepresented in the media

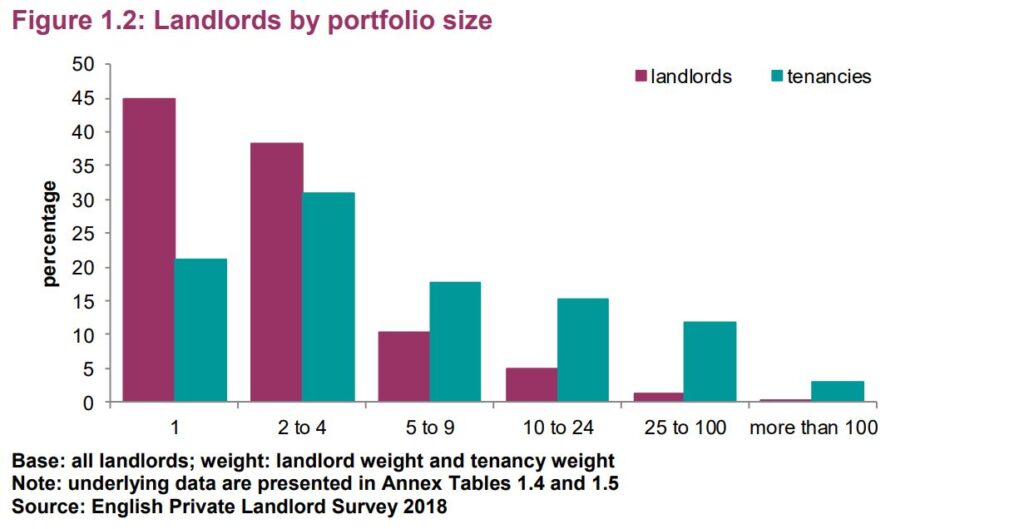

While modern landlords currently carry a lot of negative sentiment in the majority of the media and popular politics. The stereotypical image of a ‘monolopy’ style landlord is woefully out of date, according to the latest English Private Landlord Survey from the Ministry of Housing, Communities and Local Government.

While its true some rogue landlords and bad players have grabbed the headlines. On the most part, the 1.5 million private landlords continue to provide much needed homes for the rental sector. With 45% of these Landlords only owning a single buy to let property.

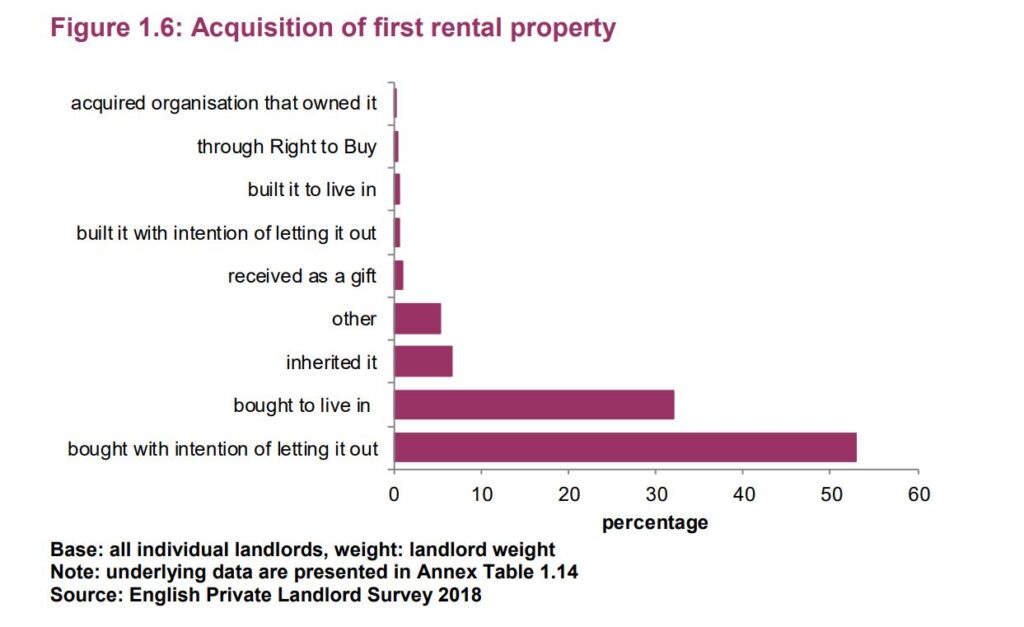

With over 30% of landlords only inheriting or buying their initial buy to let property to live in themselves.

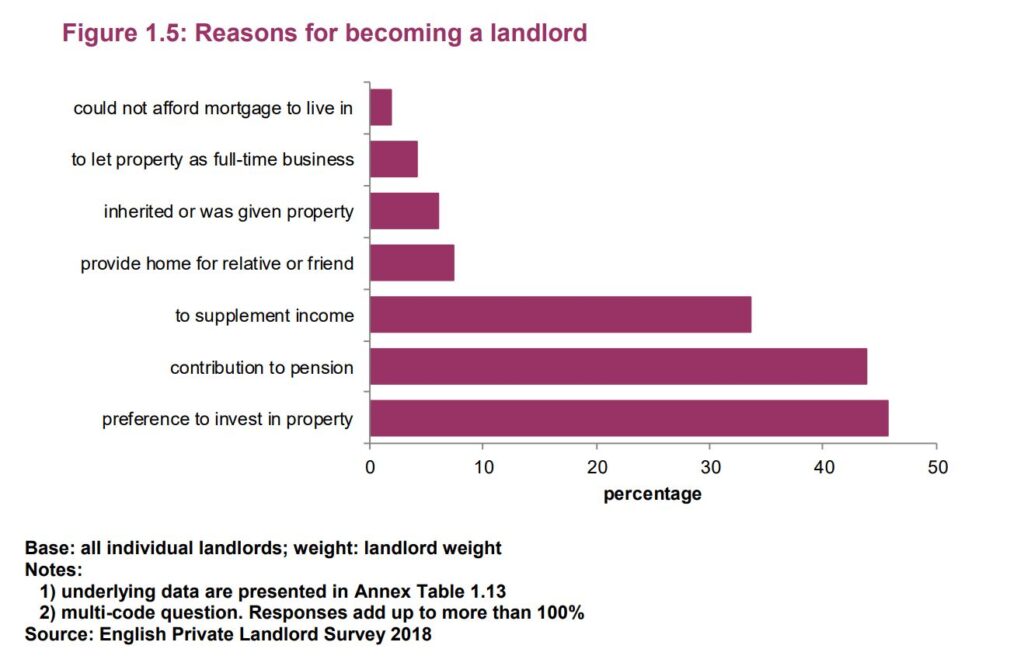

For wide range of reasons. From being a secondary income to supplementing their pensions. With an average gross rental income (before tax and other deductions) of £15k per annum.

Source: http://www.arla.co.uk/lobbying/private-rented-sector-reports/

Ministry of Housing, Communities and Local Government English Private Landlord Survey