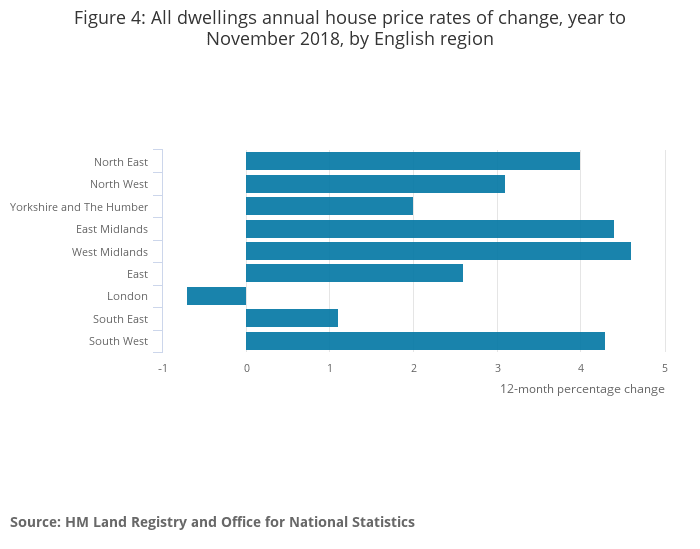

The West Midlands was the best-performing region in the latest house price figures from the Office for National Statistics (ONS) and outperformed the UK overall, while London slipped back.

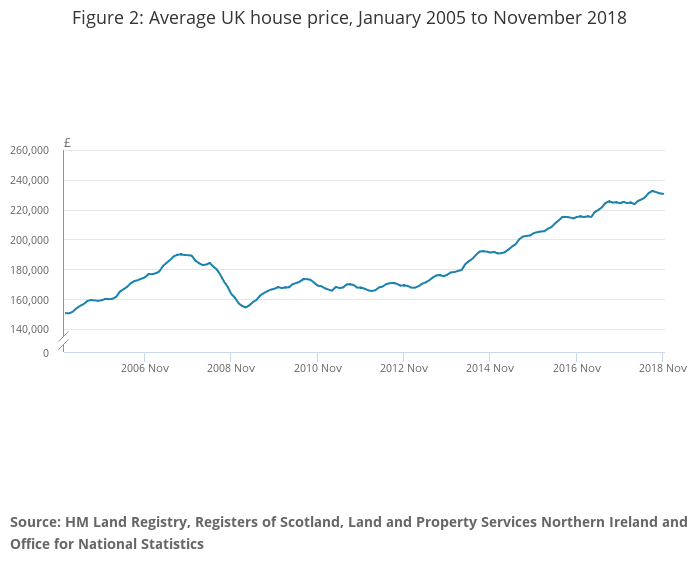

Average prices in Birmingham and the surrounding area went up by 4.6% in the year to November, while nationally they rose by 2.8% in the same period, a slight rise on 2.7% recorded in October. The ONS’ data, compiled from the Land Registry, puts the country’s average residential property price at £231,000. However, London was the only English region to record a fall with prices dropping by 0.7%.

Good times for Birmingham and surrounding area

The performance of the West Midlands follows on from other statistical findings and more anecdotal evidence that point to a successful time for the region’s property market. Home.co.uk’s Asking Price Index showed a rise of 5.2% to a figure of £250,000 late last year, while other figures from the ONS showed record numbers of people fleeing London to live in Birmingham.

Major employers including HSBC and Deutsche Bank have relocated large portions of their operations to the city, while the construction of the HS2 rail link will see high numbers of people needing a place to live in the area. Other projects such as building work for the Commonwealth Games in 2022 will also require a workforce, who will be attracted by an affordable average asking price of £197,000.

Looking around the UK with a less English-centric focus reveals that house prices in Wales over the year to November rose by an impressive 5.5% to an average £161,000. Homes in Northern Ireland went up by 4.8% in the year to Q3 to £135,000, while in Scotland they rose by 2.9% over the year to £151,000.

Brexit casts a shadow over the capital

The subdued performance of London’s property is likely to be tied to the ongoing uncertainty around Brexit, an issue that is rumbling on following the huge defeat for Prime Minister Theresa May in the House of Commons this week.

“On the one hand, the risk of uncertainty for the property market increases after yesterday’s Brexit deal vote,” said Jeremy Leaf, London estate agent and former chairman of the Royal Institute of Chartered Surveyors, “but on the other, it helps to concentrate minds on all sides as the threat of a ‘no deal’ rises, which was reflected in sterling’s strengthening immediately after the result was announced.”

John Goodall, CEO and co-founder of buy-to-let specialist Landbay, said: “These figures are likely to be a slight reprieve for ‘Brexit-ed’ out homeowners, unable to face more uncertainty-linked price turbulence.

“Looking into the detail, rising prices in the north have helped bridge some of the gap between those in London. Homeowners in the capital have been impacted by the upper stamp duty threshold, limiting their ability to move.

“There’s no escaping the fact that confidence in the market is low, bogged down by Brexit and economic uncertainty. However, these figures point to an opportunity for those in a position to buy. The combination of low prices, solid wage growth and attractive borrowing costs often proves to be too difficult to resist.”