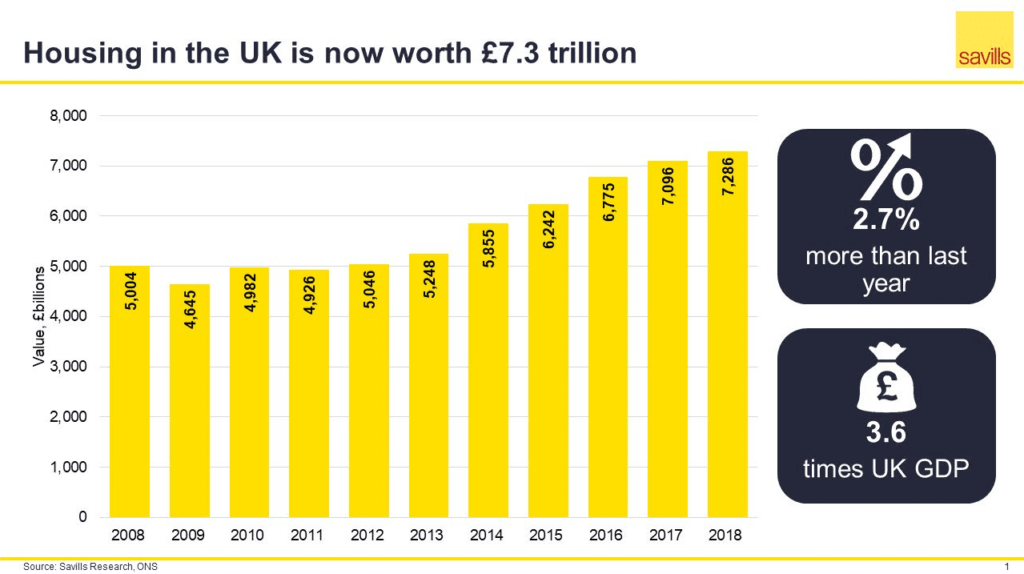

The value of the UK’s housing stock increased to a new record of £7.29 trillion in 2018, with the country’s regions making gains while London’s market recorded a fall for the first time in a decade.

New research by property adviser Savills shows the regions around England, Scotland, Wales and Northern Ireland recording rises in value. The latter enjoyed a 6% uptick to a new total of £100.7 billion, but the south-east heads the list in value terms, rising by 2.2% to £1,387.5 billion.

London still dominates the landscape

Total housing property in the capital fell for the first time since 2009 with a drop of 1.5%, but at £1.77 trillion London’s homes still account for a quarter of the UK’s total value. Birmingham, Manchester, Edinburgh, Glasgow, Cardiff, Bristol, Liverpool and Sheffield all saw faster rises than in London last year, but the capital’s total worth is still four times those cities put together.

Wales saw a rise of 6.3%, with property in the Principality now totalling £226 billion. Across the Midlands, the total value rose by 6.2% in the East and 6.1% in the West to £389.3 billion and £468.2 billion respectively.

Value of new homes increases

Drilling down into Savills figures away from the regional aspect reveals other important facts. New homes account for 28% of the £190 billion – an increase of 2.7% – added to the value of the UK’s housing stock since 2017. The previous decade had seen new builds account for only a fifth of all homes, but 2018’s increase bodes well if the country’s housing shortage is to be tackled.

Under 35s account for just 4.9% of homeowner equity, while over 65s own now own a record 43.5%.

“Once again, we see that wealth concentrated in ever fewer, older hands, to the extent that the UK’s over 50s hold a quarter of all UK homeowner equity, while the over 65s in London and the South of England alone account for over three-quarters of the total,” commented Lawrence Bowles, residential research analyst at Savills.

“Our analysis demonstrates the scale of the housing market and underlines the importance of housing to the economies of London and the UK as a whole, both as an asset class and store of private wealth.”

The value of homes in the private rented sector grew by 4.1%, the fastest of any type of tenure in 2018, to go just over £1.5 trillion for the first time.