Asking prices in the UK fell year-on-year for the first time since 2011 as Rightmove’s latest figures reflected a market still affected by Brexit uncertainty.

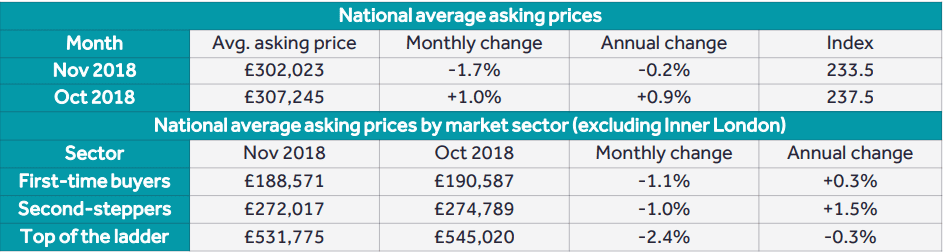

At £302,023, the average asking price for a property is £607 or 0.2% lower than it was 12 months ago, the first fall in that figure in Rightmove’s House Price Index for seven years.

On a monthly basis, asking prices were down by 1.7% – £5,222 – the biggest drop since 2012. However, the falls in London and south east prices of £10,793 and £8,647 respectively may have dragged down the overall figures. At the same time, the number of homes sold last month was up by 1%.

“New sellers and their agents are reacting to market forces and lowering their pricing aspirations by more and sooner than usual,” said Rightmove director and market analyst Mile Shipside.

“While many thought that the down-to-the-wire Brexit deal uncertainty would hold people back from buying, more buyers have actually jumped in.”

Advice being taken on board?

With Prime Minister Theresa May presenting her Brexit deal to the country last week, further effects on the property scene are certain to play out – but exactly how is unclear.

Brian Murphy, the Mortgage Advice Bureau’s head of lending, said the figures could reflect a sensible appraisal of the current situation by all concerned. “Given current political and economic headwinds, this may be the result of estate agents providing their clients with pragmatic advice that vendors are taking on board, particularly if they are motivated to move in the short term.”

Rightmove data

As ever, analysis of the figures reveals a complex picture. The monthly asking prices in the North East and North West of England fell by the same percentage – 0.6% – but over the year they were up by 3.5% and 3.2% respectively. In Yorkshire and Humber, prices were down by 2.4% in the last month.

The West Midlands also showed a monthly drop, but the region’s annual performance was strong with a growth of 4.4.%. At 61 days, the national average for number of days to sell a property was the same as last month, and down from a peak of 72 days in January.

Other recent pieces of analysis, such as the Royal Institute of Chartered Surveyors and Post Office Money, also show a cautious scene indicating an element of ‘wait and see’ over Brexit and the next few months in the economy.