According to a recent Mortgage Saver Review by online mortgage broker Trussle, headline mortgage rates are misleading borrowers and could be costing them thousands of pounds.

At first glance, it may seem that the lowest rates are the cheapest option, but a higher rate could actually be the better choice once you have factored in fees and incentives.

Mortgage deals are presented in many different ways to prospective borrowers, but the key focus is usually the headline interest rate, as a low rate will draw a customer’s attention. The problem is that the headline rate cannot tell you how truly competitive the mortgage deal is compared to others, and the fees and charges are usually buried away in the small print.

Choosing the best deal can be a challenge

Choosing the best mortgage deal is a stressful experience for many borrowers. Having to make sense of rates, fees and incentives can be a challenge – especially when there is no industry standard in the presentation of the facts. Of 2,000 borrowers surveyed by Trussle, fewer than 30% understood all the information presented by lenders, and 46% found the whole process confusing. 9% of borrowers even felt that the deals were hiding important information. Overall, 74% of borrowers want all fees and charges to be rolled up into an easily comparable, total true cost for the period of the deal.

Helping borrowers make the right choice

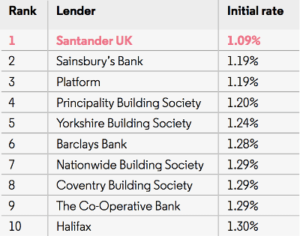

Trussle took the information of the ten lowest two-year fixed rate deals available on the market from 72 lenders (with a loan-to-value of 60%), and ranked them based on their initial rate.

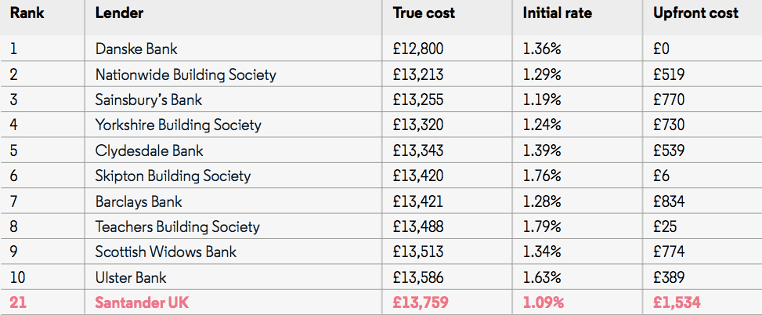

Then they re-ranked the same 72 deals by their ‘true-cost’, taking into account the fees and incentives associated with each mortgage deal.

What the data shows is that the lowest-rate deal on the market can be beaten by a higher-rate deal when the true cost is compared. For example, Santander leads the two-year fixed market with an attractive low headline rate of 1.09%, but when the products are re-ranked with their true cost (combining fees and incentives), it drops to 21st in the rankings. Danske Bank’s higher rate of 1.36%, which some borrowers wouldn’t consider at first glance, jumps from 15th place to first place based on its true cost.

Trussle is calling for the introduction of an industry-wide ‘true-cost’ metric that would take into account the additional costs and offered incentives with each mortgage. This would give borrowers a true picture of how one mortgage deal compares to another, enabling them to make a truly informed decision.

It’s time for mortgage costs to be transparent

Transparency in the form of the ‘true-cost’ would certainly make choosing a mortgage deal simpler for many. In the meantime, borrowers can help make sense of the mortgage jungle by using the information available on moneyfacts.co.uk or moneysavingexpert.com.

MoneyFacts Best Buy charts are sorted by APRC (annual percentage rate charge), so you can be sure that the deal at the top is the one with the lowest rates and fees for the term or mortgage type you are seeking. The Money Saving Expert mortgage best buys tool shows you which deal is really the cheapest overall, taking interest and fees into account to give you the total cost of the mortgage for one year.

Until mortgage lenders all agree to present mortgage deals in a ‘true-cost’ comparable format, borrowers will have to actively investigate, review and evaluate the products available to make sure they are getting the best mortgage rate, and not just the one that on the face of it looks like a great deal.

Source for tables: https://trussle.com/blog/mortgage-saver-review-feb-2018