A think tank recently published its forecasts stating that a home will still cost £40,000 more in five years’ time. And that despite any uncertainty stemming from the Brexit surprise.

The Centre for Economics and Business Research (Cebr) said that while property values are expected to experience a weaker growth for the rest of 2016 and 2017, the overall direction of prices is still expected to rise.

This increase means the average UK house prices could go up from £194,000 in 2016 to £234,000 in 2021 – an increase of £40,000.

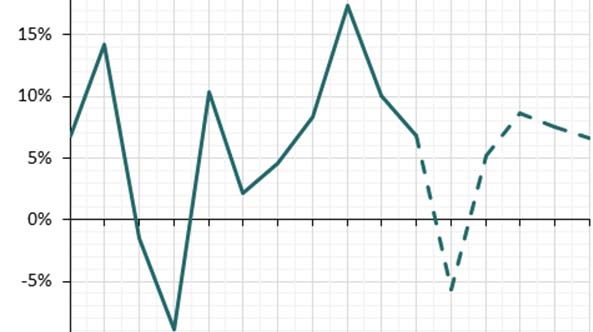

For 2016, the economic forecaster revealed an increase in house prices of 5.7%. Earlier this year the growth level was at 8%, but Cebr expects to see a slowdown in house price growth over Q3 and Q4.

This slowdown in growth will be mainly caused by the rush earlier this year by investors trying to beat the stamp duty increase combined with general uncertainty following the Brexit vote.

Over 2017, property values in the UK are expected to increase at only 2.2%. In London, however, prices are expected to fall by 5.6% over the next year.

Cebr said: “Some of the global regions that many of London’s non-UK buyers come from such as Russia and the Middle East are experiencing economic turmoil and are not as able to invest.”

Many reports on the current housing market have highlighted a lack of properties available as a reason for house prices remaining high.

Furthermore, Cebr says it expects the impact of the Brexit result to lessen the more negotiation are progressing.

After 2021, developments in the housing market will strongly depend on the immigration and economic policies the UK negotiates with the rest of the world, Cebr said.

Nina Skero, Cebr senior economist and the main author of the report, said:

Although Brexit has certainly sent shockwaves, Cebr expects the housing market to slow down but not plummet.

Years of underbuilding mean that demand would have to fall very dramatically to meet the low level of supply increases. Keeping in mind that construction companies are very likely to limit their output further in light of Brexit, price pressures will also come from the supply side.”