Homes in British cities are less affordable now than at any time in the last eight years. And the situation just got worse: this year urban house prices suddenly inflated even more.

On average, a city property in the UK now costs 6.6 times the average earnings, an increase from 6.2 time one year ago, with Houses in Oxford, Cambridge and Winchester being the most out of reach for possible first time buyers.

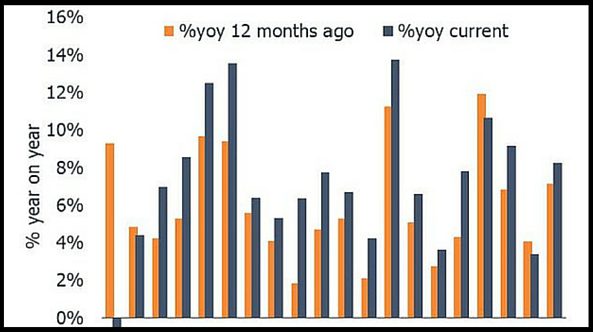

At the same time, February saw a sudden explosion in values which will dramatise the situation. Hometrack showed in its monthly report that urban property inflation rose to 11% from 8.1% one year ago, representing the highest annual rate of growth for almost 18 months.

The report identified London, Bristol, Oxford and Cambridge as the cities showing the greatest home value increase compared to February 2015. In two of those cities recent inflation even approached 14%.

Richard Donnell at Hometrack noted an “unseasonal acceleration in city level house price growth in the last three months”.

“Sixteen of the 20 cities covered by our index are registering an annual rate of house price growth that is higher than 12 months ago,” he added.

“As the housing recovery spreads some regional cities are recording their highest growth rates for over a decade. Four cities have seen the rate of growth slow, with Aberdeen and Belfast hardest hit.”

“Belfast in particular has lost momentum where a modest recovery appears to have stalled with house prices still 45 per cent down on their 2007 levels.”

Recently, the Office for National Statistics published data revealing the average UK house price has jumped up by 7.9% since January 2015, reaching a new record high of £292,000.

The average property value in England now stands at a record high of £306,000, whilst house prices in London average at £551,000 after a 10.8% increase year-on-year. Only the South East outside of London, with average house prices of £374,000, exceeded the capital’s growth rate with an increase of 11.7%.

A research by Lloyds Bank said the affordability of a home in UK cities is not at its worst in eight years, after the average house price-to-earnings ratio increased to 7.2 during the height of the last housing market boom in 2008.

Flats – The winner since 2008

On average, the value of a flat has increased by £1,000 a month since the financial downturn, which makes it the UK’s best performing property type over the period.

The price of a typical flat has gone up by £86,474, equalling £1,029 a month, since the property price dip in late 2008. By the end of 2015, the cost of an average flat reached £237,223, according to Halifax.

Comparing this to other property types and their price rise:

- Average price rise of a flat: 57%

- Average price rise of a terraced house: 38%

- Average price rise of a bungalow: 28%

- Average price rise of a semi-detached house: 34%

- Average price rise of a detached property: 20%

However, much of these increases are fuelled by London’s powerful housing market, with a high concentration of flats. In the capital, flats account for 50% of all property sales, compared to a UK average of 17%.

According to Halifax, excluding London from those statistics would make terraced homes the best price-performers.

Martin Ellis, a housing economist at Halifax, said: “The high prices being paid for London flats have had a significant impact on the national picture when it comes to property type winners and losers.”

“This is the result of more flats being sold in the capital and at the higher end of the market.”

Source: This Is Money