The property price in the UK has recently surpassed the £300k mark with its engine being fuelled by growth in the country’s North and West rather than the capital.

According to a leading property website, for the first time in history, buying a house in England and Wales will cost you more than £300,000 on average.

Rightmove explained that, with a shift of the engine of property value growth from London to the country’s North and West, the average asking price for a home went up to £303,190 in March. In February the average price was at £299,287.

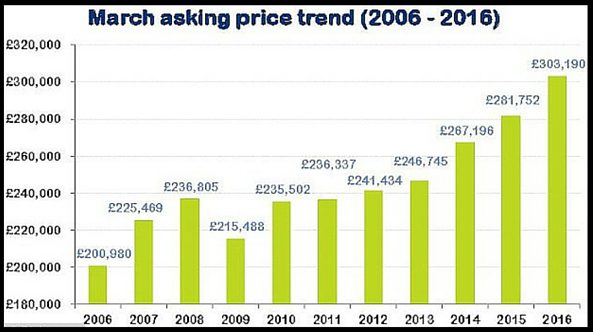

Within one decade, asking prices have jumped up over £100,000, from an average of £200,980 in March 2006 to £303,190 currently.

Six regions registered new record average prices in March:

- London: £644,045

- South West: £292,251

- South East: £399,680

- East of England: £326,836

- West Midlands: £204,140

- North West: £177,437

Rightmove named the recent momentum spreading across the north and west of the country as opposed to London as the driving force for the growth in property prices.

The property platform added that London is now a split market with some boroughs seeing an increase in prices while others are experiencing a drop.

Rightmove’s Mr Shipside believes that the UK’s first-time buyers and trade-up homeowners are far from being able to cope with the current prices, especially in combination with stricter mortgage lending rules and average earnings falling short behind the growth of house prices.

He continued: “However, stronger growth in average earnings would not have helped the situation, as it would simply have enabled buyers to bid prices up even higher, chasing the limited supply of suitable housing stock.”

Nicky Chute, an estate agent with Foxtons in London, said: “Last year the volume of sales fell across all London zones but least so in zones three to six, whilst prices continued to rise.”

“For example, last year 514 properties were sold in Pimlico and Westminster with an average price of £1.2million, making the market worth £618million.”

“In Walthamstow, where Foxtons opened a branch in 2015, 1,722 properties sold for an average of £395,000, amounting to £680million in sales. This now makes Walthamstow in outer London a larger market than Pimlico and Westminster in central London.”

Rightmove director Miles Shipside said: “While the start of 2016 has seen an encouraging but modest uptick in the number of properties coming to market, demand and momentum have combined to push prices over £300,000.”

“On average, 30,000 properties have come to market each week over the past month, up by 3 per cent on this time last year, but there are insufficient numbers of newly listed properties in many parts of the country to meet demand.”

“Visits to the Rightmove website are up by 14 per cent in early March compared to the same period in 2015, so it’s no surprise that those buyers who can borrow more or can find some extra cash are keeping the price merry-go-round spinning.”

Some reports suggested that the stamp duty increase which will come into play for buy-to-let investors from April 1 fueled a rush of landlords buying up property before the deadline.

Earlier in March, the UK’s two biggest mortgage providers painted a mixed picture of the country’s house prices. Whilst Halifax reported a price increase of 0.3% for February, Halifax registered a decline of 1.4%.

Moving away from volatile monthly figures, both agreed on a fairly constant house price inflation.

Source: This Is Money